Flexible Summer Schedules: Enhancing Work-Life Balance

As the sun shines brighter and temperatures rise, the allure of summer beckons us outdoors, inviting us to enjoy moments with family and friends. Especially in Alberta, where the summer […]

As the sun shines brighter and temperatures rise, the allure of summer beckons us outdoors, inviting us to enjoy moments with family and friends. Especially in Alberta, where the summer […]

As we find ourselves midway through 2024, it is an opportune moment to pause and reflect on the first half of the year. For both employers and employees, this midpoint […]

Tailored Benefits Will Help Employees Achieve Their Goals & New Years Resolutions What Tailored Benefits Will Help Your Employees Achieve Their Goals? With the new year upon us, and employees returning to their (home) offices after […]

Modifying Employee Benefits & Minimizing Resistance Making employee benefits changes and package modifications are sometimes not easily understood by staff. In some cases, making changes to employee […]

A Toronto restaurant found a unique approach to employee benefits funding. The restaurant began adding a 3% surcharge to each bill, with the funds to be used […]

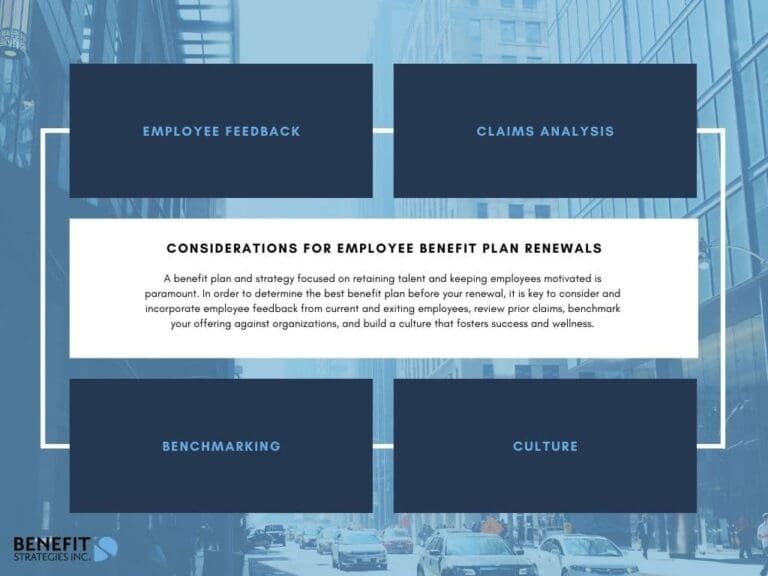

4 Components to Consider for Your Next Employee Benefits Renewal Offer An Employee Benefits Renewal that Will Motivate Offering a competitive employee benefits renewal is a strong motivator for staff and a productive and cost-effective way […]

Canada Critical Illness Insurance – FAQ The purpose of this critical illness insurance FAQ blog post by Benefit Strategies, is to offer answers to some very basic questions that most Canadians have on this subject. A critical […]

The overall trend in the last several years for employee benefits is to move away from traditional or fixed benefits to more tailored, custom benefit plans. One […]

When it comes to employee benefits vs salary, as many as 79% of employees prefer the perks that employee benefits can bring over getting a pay increase, says a […]

What Makes A Good Benefits Package? Do You Know What Is Considered A Good Benefits Package? Business owners know that offering an attractive employee benefits plan is a wise investment, but what is considered a good benefits […]